|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

Is Monster Beverage Stock Outperforming the Nasdaq?

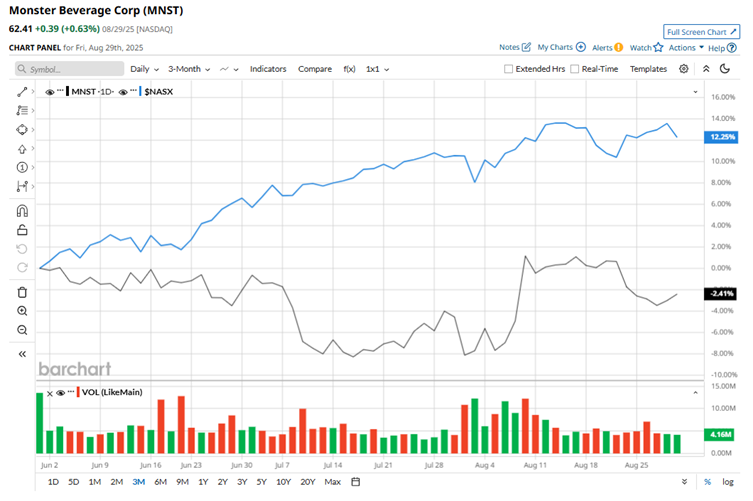

With a market capitalization of around $60.9 billion, California-based Monster Beverage Corporation (MNST) stands as a leading marketer and distributor of energy and alternative beverages. The company operates through three key segments: Monster Energy Drinks, Strategic Brands, and Other, providing a broad presence across the global beverage landscape. Companies valued at $10 billion or more are generally classified as "large-cap" stocks, and Monster Beverage falls squarely into this category, with a market capitalization that exceeds this threshold. The company’s subsidiaries boast a powerhouse portfolio of drinks spanning energy, hydration, and alcoholic beverages. Its lineup includes iconic brands like Monster Energy, Reign, NOS, and Bang, alongside innovations such as Java Monster coffee-energy blends and Rehab non-carbonated options. Beyond energy drinks, the company also markets still and sparkling waters under the Monster Tour Water brand and has expanded into alcoholic offerings, with craft beers, hard seltzers, and flavored malt beverages, under brands such as Jai Alai, Dale’s Pale Ale, Wild Basin, and The Beast. Shares of this beverage giant have pulled back only 6.5% from its recently achieved 52-week high of $66.75 on Aug. 8, thanks to its latest strong quarterly report. Over the past three months, the stock has been down roughly 2%, lagging behind the Nasdaq Composite's ($NASX) 11.9% return during the same stretch.

Looking at the bigger picture, though, MNST’s longer-term performance stands out. The stock has soared 32.7% over the past year, comfortably outpacing the Nasdaq’s 22.2% gain. Year-to-date, it has climbed 18.7%, once again ahead of the broader index’s 11.1% rise. To highlight its bullish trend, Monster Beverage has stayed firmly above its 200-day moving average since February, signaling strong underlying momentum. The stock has also managed to hold above its 50-day moving average over the same period, weathering bouts of volatility along the way.

Monster Beverage is flexing its dominance in the energy drink arena, with its stock getting a strong boost after blockbuster fiscal 2025 second-quarter results. Reported on Aug. 7, the company delivered record net sales of $2.11 billion, up 11.1% year over year, marking the first time quarterly revenue topped the $2 billion milestone. The results easily surpassed analyst expectations of $2.08 billion, while adjusted EPS of $0.51 also beat the $0.48 forecast. Investors cheered, sending shares up 6.4% on Aug. 8. Moreover, the company has also managed to outperform its rival Keurig Dr Pepper Inc. (KDP). While MSNT has delivered substantial gains, KDP’s performance has been far less impressive, with the stock slipping nearly 19.7% over the past year and sinking another 9.4% so far in 2025. The contrast highlights MNST’s stronger momentum in the competitive beverage space. Considering Monster Beverage’s solid long-term price action, Wall Street appears to take an optimistic stance on this stock. Of the 23 analysts covering the stock, the consensus rating stands at “Moderate Buy,” with an average price target of $67.27, implying about 7.8% upside from current levels. On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|