|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

Honeywell Stock: Is HON Underperforming the Industrial Sector?/Honeywell%20International%20Inc%20operations%20facility%20by-JHVEPhoto%20via%20iStock.jpg)

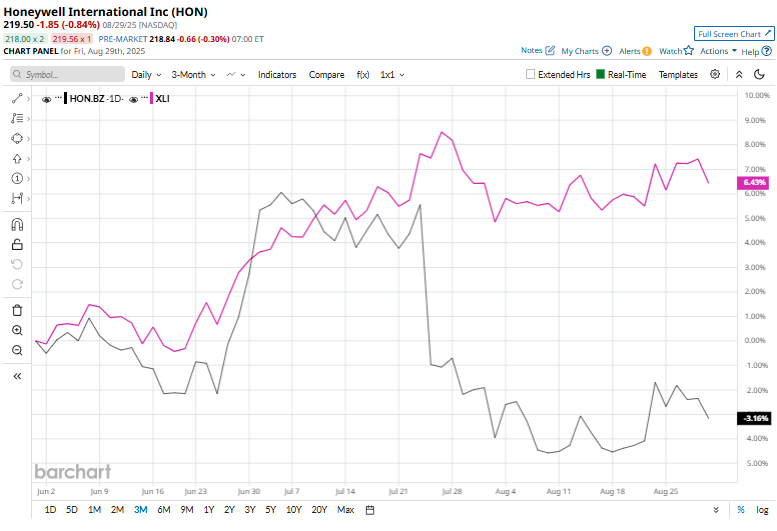

Valued at a market cap of $139.4 billion, Honeywell International Inc. (HON) is a global technology and manufacturing company headquartered in Charlotte, North Carolina. Operating across aerospace, building technologies, performance materials, and safety solutions, it serves industries from aviation to energy. Companies worth $10 billion or more are typically classified as “large-cap stocks,” and HON fits the label perfectly, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the conglomerates industry. With a strong focus on automation, sustainability, and digital transformation, Honeywell is known for innovation, diversified revenue streams, and a large global presence. This tech industrial company is currently trading 9.6% below its 52-week high of $242.77, reached on Nov. 12, 2024. HON has dropped 2.5% over the past three months, trailing the Industrial Select Sector SPDR ETF Fund’s (XLI) 6.5% return over the past 52 weeks and 15.1% rise on a YTD basis.  In the longer term, HON has rallied 7.1% over the past 52 weeks, lagging behind XLI’s 17.7% return over the same time frame. On the other hand, shares of HON are down 2.8% on a YTD basis, underperforming the XLI’s 15.4% rally over the same timeframe. HON has been trading below its 200-day moving average since the end of July, but has edged above its 50-day moving average over the past few trading sessions.  On August 20, HON shares surged marginally after announcing the acquisition of three utility platforms—Praxis, GridScan, and GridFin—from SparkMeter, Inc. to strengthen its Smart Energy portfolio. The integration of these grid intelligence technologies with Honeywell Forge Performance+ for Utilities will provide utilities with advanced tools for data-driven grid modernization, improved asset management, operational visibility, and financial optimization, helping them meet growing energy demands more efficiently. HON has considerably lagged behind its rival, 3M Company (MMM), which gained 18,2% over the past 52 weeks and 20.5% on a YTD basis. The stock has a consensus rating of "Moderate Buy” from the 24 analysts covering it, and the mean price target of $255.05 suggests a 16.2% premium to its current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|