|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

Is Snowflake Stock a Buy, Sell, or Hold for September 2025?/AI%20(artificial%20intelligence)/Artificial%20intelligence%20and%20machine%20learning%20concept%20-%20by%20amgun%20via%20iStock.jpg)

Snowflake (SNOW), an artificial intelligence (AI) innovator, has continued its streak of robust growth, building on a strong first quarter with yet another impressive performance. The company's Q2 2026 earnings report on Aug. 27 energized investors, driving shares up approximately 20.3% on Aug. 28. The market responded decisively to this beat-and-raise quarter, propelling SNOW stock to a new 52-week high of $249.99 on Aug. 28. Confidence was further bolstered as management raised the full-year guidance, signaling both resilience in operations and the strength of its underlying business model. The durability of demand is evident in Snowflake’s substantial addressable market and its robust backlog, reflected in remaining performance obligations. These factors continue to underpin bullish sentiment on Wall Street, as analysts recognize the company’s ability to deliver consistent growth while scaling efficiently. About Snowflake StockHeadquartered in Bozeman, Montana, Snowflake powers the AI Data Cloud, a platform that consolidates enterprise data into a single source. With a market capitalization of approximately $79.6 billion, its technology enables organizations to analyze information, apply AI for complex business solutions, build custom data applications, and share data products efficiently. SNOW stock has performed exceptionally well, rising 114% over the last 52 weeks and delivering a year-to-date (YTD) gain of 55%. Momentum remains strong, with shares up 21% over the past five trading days, reflecting investor optimism in the wake of strong quarterly results.

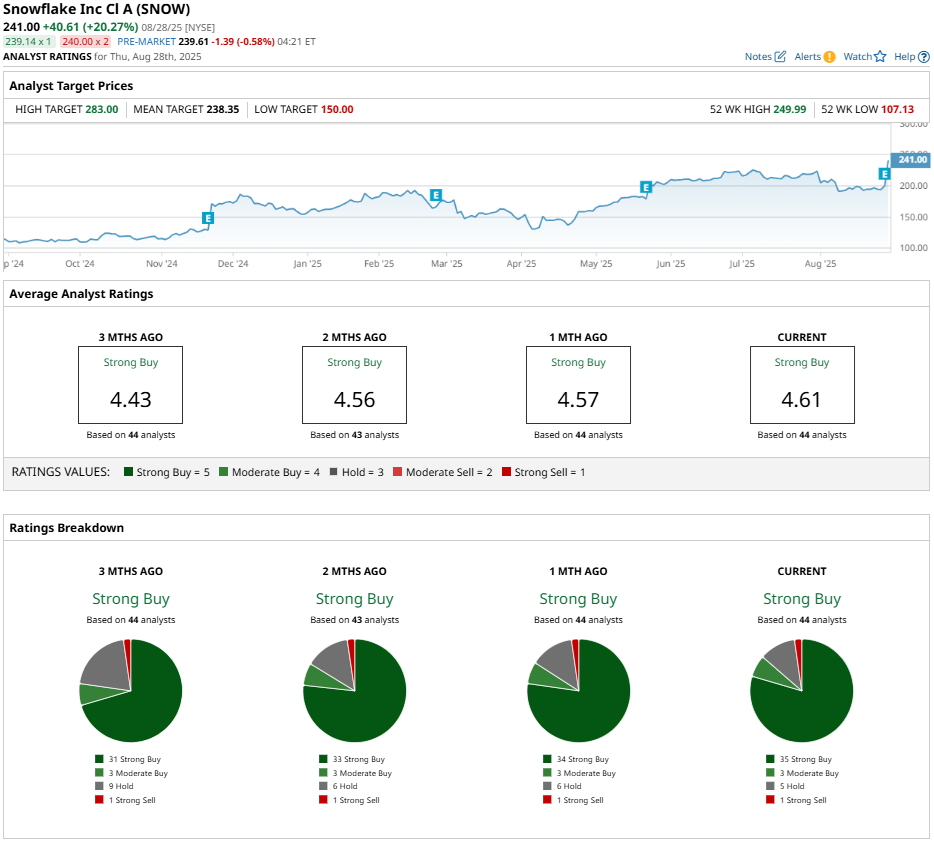

SNOW stock trades at 208 times forward adjusted earnings and 21.97 times sales. Snowflake Surpasses Q2 EarningsOn Aug. 27, Snowflake announced Q2 2026 results that exceeded Wall Street expectations. Revenue rose 32% year-over-year (YOY) to $1.1 billion, slightly surpassing the Street’s projection of $1.09 billion. Product revenue matched at $1.09 billion, reflecting 32% YOY growth. Customer growth remained strong, with net new additions up 21% compared to the prior year, and the quality of customers improved alongside quantity. During the quarter, 50 customers surpassed $1 million in trailing 12-month (TTM) revenue, pushing the total number of such high-value customers to 654, while the overall customer count reached 12,062. Forward-looking indicators also show promise. Remaining performance obligations rose 33% YOY to $6.9 billion, and the net revenue retention rate stayed robust at 125%, signaling that existing customers continue to expand their usage steadily. Operational gains translated into stronger profitability, with adjusted operating margins reaching 11%, up from 5% a year ago. Non-GAAP net income grew 104.4% to $129 million, while adjusted EPS climbed 94.4% to $0.35, beating analyst estimates of $0.27. Looking forward, Snowflake projects October quarter product revenue between $1.125 billion and $1.13 billion, while raising full-year product revenue guidance to $4.4 billion. Meanwhile, analysts expect Q3 2026 loss per share to narrow by 30.7% YOY to $0.61, and full-year fiscal 2026 loss per share to decline 30.6% to $2.43. What Do Analysts Expect for Snowflake Stock?Morgan Stanley has taken a particularly bullish stance on Snowflake, with analyst Sanjit Singh raising the price target from $262 to $272 and maintaining an “Overweight” rating. The firm views Snowflake as a premier opportunity to capitalize on the ongoing trend of data modernization in enterprise software. SNOW maintains a consensus rating of “Strong Buy” among 44 analysts covering the stock. Of these, 35 recommend a “Strong Buy,” three give a “Moderate Buy" rating, five provide a “Hold" rating, and one analyst has a “Strong Sell.” SNOW stock has an average price target of $256.90, implying 8% potential upside from current levels. Meanwhile, the Street-high target of $285 reflects a 19% potential gain from here.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|